How Identity Theft Differs From Fraud and Data Breaches

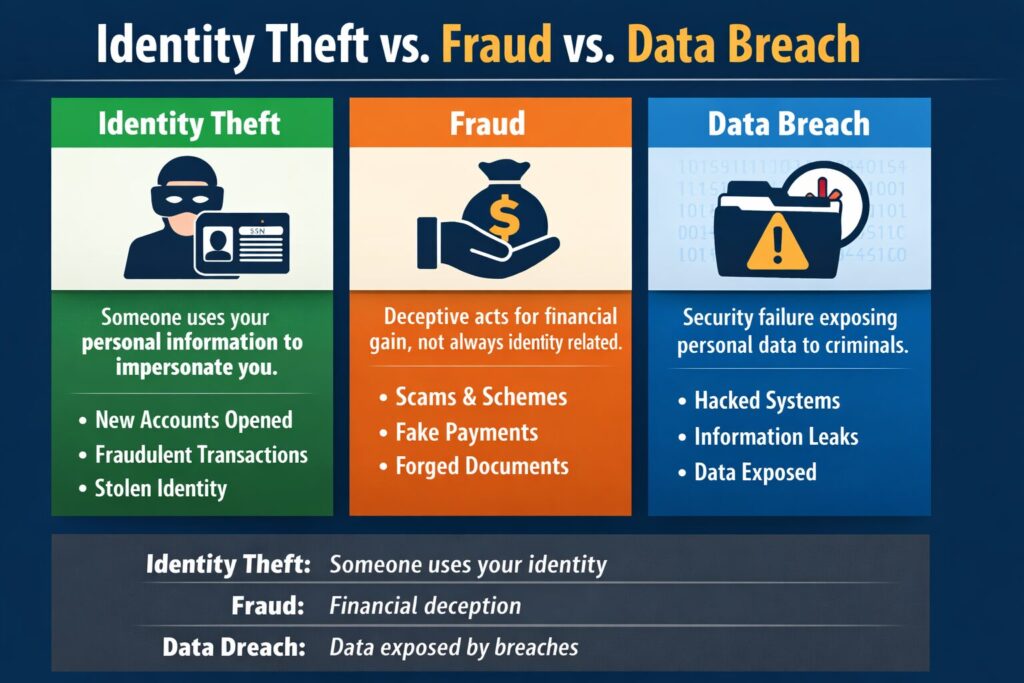

The terms identity theft, fraud, and data breach are often used interchangeably, but they describe very different events. Understanding how they differ is important, especially if your personal or financial information has been compromised and you are trying to determine what happened and what steps to take next.

While these issues are closely related, each one involves a distinct type of risk, responsibility, and potential impact on consumers.

What Is Identity Theft?

Identity theft occurs when someone uses your personal information to impersonate you. This typically involves stolen data such as your name, Social Security number, date of birth, bank information, or credit details. For more details, we outline what exactly is identity theft, and also offer other Frequently Asked Questions.

Once someone has assumed your identity, they may:

- Open credit cards or loans in your name

- File tax returns using your information

- Apply for government benefits

- Access existing bank or financial accounts

- Create accounts or contracts that appear to be yours

What makes identity theft unique is impersonation. The thief is not just stealing money or data — they are acting as if they are you.

This often results in long-term consequences, including credit damage, collection notices, and repeated efforts to correct inaccurate records.

What Is Fraud?

Fraud is a broader category that refers to intentional deception used to gain money, services, or other benefits. Identity theft is considered a type of fraud, but not all fraud involves identity theft.

Examples of fraud that may not involve identity theft include:

- Phishing scams

- Fake payment requests

- Forged checks

- Unauthorized transactions using stolen card numbers

- Investment or lottery scams

In these situations, a victim may lose money without the fraudster fully taking over their identity. The key difference is that fraud focuses on deceptive activity, while identity theft involves misuse of a person’s identity itself.

What Is a Data Breach?

A data breach occurs when personal or sensitive information is exposed due to a security failure. This may happen when a company, government agency, or organization experiences hacking, system vulnerabilities, or improper handling of records.

Common causes of data breaches include:

- Cyberattacks or ransomware incidents

- Weak cybersecurity practices

- Lost or stolen devices

- Accidental disclosure of records

A data breach does not automatically mean identity theft has occurred. Instead, it means personal information has been exposed and may be vulnerable to misuse in the future.

In many cases, identity theft or fraud happens after a data breach, once stolen information is sold or used by criminals.

How These Issues Are Connected

Although identity theft, fraud, and data breaches are different, they often follow a related sequence:

- A data breach exposes personal information

- Stolen data is used to commit fraud

- Fraud escalates into identity theft when impersonation occurs

Not every breach leads to identity theft, and not every fraud case involves a breach, but understanding how these events connect can help clarify what may have happened in your situation.

Why the Distinction Matters

Knowing whether you are dealing with identity theft, fraud, or a data breach can affect:

- How you report the issue

- Which organizations you notify

- What records need to be corrected

- How long the recovery process may take

Identity theft typically requires ongoing monitoring and correction, while fraud may involve reversing specific transactions. Data breaches often require vigilance and preventative steps to reduce future risk.

Understanding the difference can also help you recognize whether the problem is isolated or part of a larger exposure.

What to Do If Your Information Has Been Compromised

If you believe your personal information has been exposed or misused, taking action early can help limit the damage. This may include monitoring accounts, reviewing credit activity, documenting any unauthorized use, and contacting an attorney.

Because identity theft and fraud can involve multiple parties and long-term consequences, many individuals choose to seek professional guidance to understand their options and protect their financial future. Don't hesitate to reach out to Vullings Law Group, LLC for a consultation.