Get a Free Case Review

As many as 1 in 3 Americans have errors or mistakes on their credit reports, and as many as 1 in 5 Americans have errors or mistakes that are serious enough to affect their credit scores to point of being denied new credit or refinancing existing credit. Too many consumers currently face unwarranted financial dilemmas as a result of inaccurate credit reporting. Credit report errors can impact one’s ability to retain current employment and affect one’s ability to obtain new credit, get a car loan and even secure insurance.

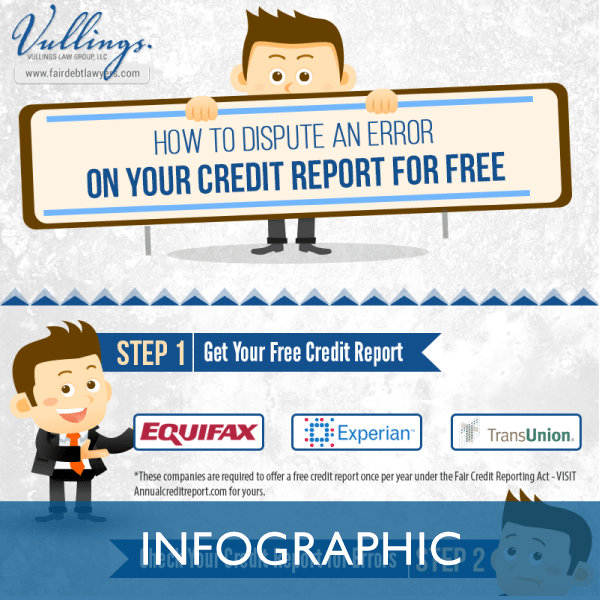

Getting Your Free Credit Report

You may think that getting a free credit report is unnecessary, because you know what it contained on the report. However, the fact is that over one-quarter of people in the U.S. have errors on their credit report which impacts their credit score; this makes it essential to access your report and verify that it is error-free. This is the first step to learning whether there is a problem that must be addressed.

How do you get a free credit report? Do not trust every website that offers to provide you with this information. Some of these websites are simply attempting to steal information including names, addresses and social security numbers. The good news is that AnnualCreditReport.com offers free credit reports to consumers. The Federal Trade Commission verifies that this website is a valid provider of free annual credit reports.

Be sure to check the URL before entering personal information. Some scam artists have registered versions of the website address that include slight typos in hopes that consumers will accidentally visit their website. Verify that the URL reads AnnualCreditReport.com before providing any sensitive personal information.

What should you do when you receive your credit report? Follow these steps to properly review the information.

- Go over your basic personal information. This is especially important if you have recently moved, switched jobs or changed your name.

- Review each credit account. Ensure that you have actually opened each of these accounts.

- Verify the amount due on each account. Use recent statements from banks or other creditors to verify the amount due.

- Look for incorrect payment information. Make sure that a creditor has not reported a missed or past due payment if you have always paid on time.

- Pay attention to credit inquiries. A credit inquiry appears on your report when you apply for credit. Inquiries from companies that you are not familiar with may result from an attempt to steal your identity.

- Look for judgment information as well as bankruptcies and foreclosures that are listed on your credit reports. Take note of these items. If you have had a bankruptcy or foreclosure, make sure that the date for each item is correct. This information will eventually be taken off of your credit report, so you want to make sure that the reference date is accurate.