Philadelphia Credit Report Error Attorney: Protect Your Credit and Financial Future

Vullings Law Group, LLC

Get a Free Case Review

Don't Let Credit Report Errors Ruin Your Financial Health

Did you know that as many as 1 in 3 Americans have errors or mistakes on their credit reports? Shockingly, 1 in 5 Americans experience errors serious enough to impact their credit scores, leading to denials for new credit or refinancing existing credit. These inaccuracies can result in unwarranted financial hardships, affecting your ability to retain employment, obtain new credit, secure car loans, or even get insurance.

At Vullings Law Group, LLC, we understand the importance of a flawless credit history. Our team of experienced credit lawyers specializes in cases involving the Fair Credit Reporting Act (FCRA) and can help you fight back against creditors and consumer reporting agencies reporting errors on your credit report.

Common Credit Dispute Question:

Question: What qualifies as a dispute on a credit report?

Answer: A dispute on a credit report refers to any discrepancy or error found in the information contained within the report, including inaccuracies in personal details or credit history.

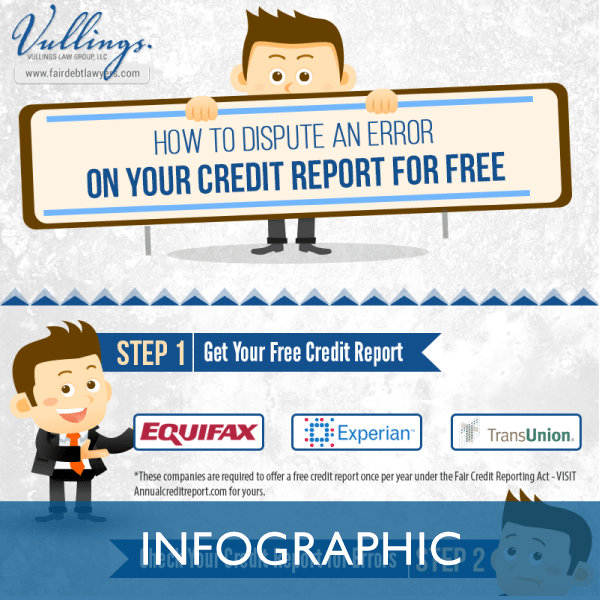

Get Your Free Credit Report Today

You may believe that obtaining a free credit report is unnecessary because you're already aware of its contents. However, over one-quarter of people in the U.S. have errors on their credit reports, adversely affecting their credit scores. This makes it essential to access your report and verify its accuracy. It's the first step towards identifying and resolving any potential problems.

But beware! Not all websites offering free credit reports can be trusted. Some are designed to steal sensitive information like names, addresses, and social security numbers. Fortunately, AnnualCreditReport.com is a verified provider of free annual credit reports, endorsed by the Federal Trade Commission.

Before entering personal information, always double-check the URL to ensure it reads AnnualCreditReport.com and avoid falling victim to scam artists who create similar-looking websites with slight typos.

How to Review Your Credit Report

Upon receiving your credit report, follow these steps to conduct a thorough review:

- Verify your basic personal information, particularly if you've recently moved, changed jobs, or modified your name.

- Review each credit account to confirm that you have indeed opened them.

- Validate the amount due on each account by referring to recent statements from your banks or creditors.

- Check for any incorrect payment information, ensuring that missed or past due payments haven't been falsely reported.

- Pay attention to credit inquiries, as unfamiliar companies may indicate attempted identity theft.

- Look for judgment information, bankruptcies, and foreclosures listed on your credit reports. Note these items and ensure their dates are accurate, as they will eventually be removed.

Protect your credit and secure your financial future with your local Philadelphia expert Credit Report Attorneys. Contact us today for a free consultation at 1-855-324-7263 or fill out the contact form on this page.

Philadelphia Resources:

Financial Empowerment Center - The City of Philadelphia offers free financial counseling services through any of the seven different Financial Empowerment Centers (FEC). This service is available to anyone who wants financial counseling services.

Women's Opportunities Resource Center - The Women's Opportunities Resource Center (WORC) offers credit counseling services. By partnering with CLARIFI, you can learn more about your credit profile, clean up, and reestablish your credit.

Philadelphia Federal Credit Union - The Philadelphia Federal Credit Union offers credit tools, credit reports, and credit counseling. Find out which credit resource is right for you.