Monroe Township Credit Report Error Attorney: Protect Your Credit and Financial Future

Vullings Law Group, LLC

Get a Free Case Review

Protect Your Financial Stability from Credit Report Errors in Monroe Township, NJ

Did you know that nearly 1 in 3 Americans have mistakes on their credit reports? Even more alarming, 1 in 5 face errors serious enough to lower their credit scores—leading to denials for mortgages, car loans, or refinancing. Here in Monroe Township, inaccurate credit reports can quickly disrupt your financial stability, affecting everything from job opportunities to auto financing and even insurance rates.

At Vullings Law Group, LLC, we understand how vital a clean credit history is to your future. Our experienced New Jersey credit attorneys focus on the Fair Credit Reporting Act (FCRA) and know how to challenge false information on your credit reports. Don’t let reporting errors dictate your financial life—our team is here to help Monroe Township residents fight back and restore their credit health. Whether you’re dealing with denials or harassment from debt collectors, we’ve got your back.

Common Credit Dispute Question:

Question: How often do merchants win credit card disputes?

Answer: The outcome of credit card disputes between merchants and customers depends on various factors, including the specific circumstances of the dispute and the evidence provided by both parties. Merchants may win disputes if they can demonstrate that the charge was valid and the product or service was delivered as agreed. However, dispute outcomes vary widely, and there's no fixed percentage of wins for either party.

Safeguard Your Credit Score in Monroe Township

Think your credit report is accurate? Studies show that nearly 25% of Americans have errors that damage their scores. That’s why checking your report regularly is critical.

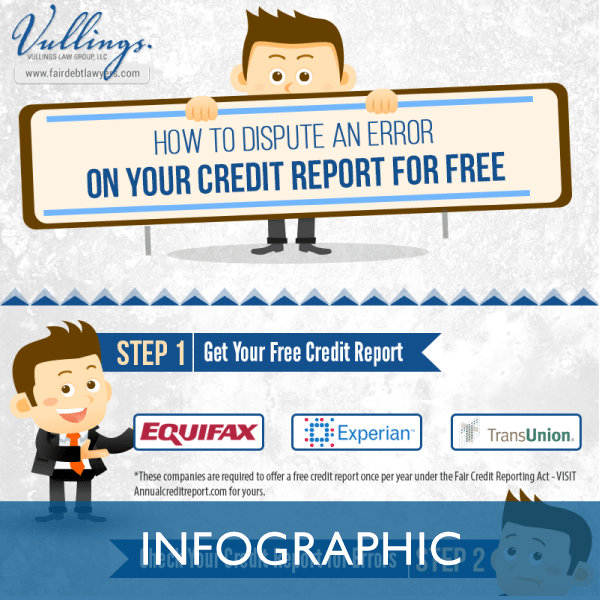

But be cautious: not all “free report” websites are legitimate. The only FTC-approved source is AnnualCreditReport.com

What to Review on Your Credit Report

When going through your credit file, make sure to:

-

Verify your personal information.

-

Confirm all credit accounts are correct.

-

Match balances with your current statements.

-

Check payment histories for errors.

-

Look out for suspicious credit inquiries.

-

Review legal judgments, bankruptcies, or foreclosures.

Don’t let credit report errors jeopardize your future. The people of Monroe Township trust Vullings Law Group, LLC to protect their financial well-being.

Call us today at 1-855-324-7263 or use the contact form on this page to schedule your free consultation and take the first step toward safeguarding your financial future.

Monroe Township Resources:

New Jersey Citizen Action of Central NJ - New Jersey Citizen Action in Central New Jersey offers financial coaching/literacy services to residents of central New Jersey, including in Monroe Township.

American Consumer Credit Counseling - Formerly Consumer Credit Counseling Service of Central New Jersey, American Consumer Credit Counseling is a nonprofit agency offering credit counseling, debt management, budgeting, and financial education to New Jersey residents, including in Monroe Township.